What is PayPal?

In modern times, the internet has been adapted and used for everything. One of the best examples of this is digital wallets. With these services, one can send and receive payments without any problem whatsoever over the internet. One of the earliest and most popular of these services is PayPal.

Initially launched in 1999 by the American Silicon Valley

company Confinity, PayPal started off as a simple digital wallet that was

adopted by eBay to grow its user base. During the last decade, PayPal

implemented new features like micro-payments and mobile payments. It also

started its expansion into other countries, with an emphasis on small and

medium businesses. In 2014, it was announced that PayPal would become its own

company independent of eBay.

Today, PayPal is widely used as a payment processor for

e-commerce websites, auctions, as a payment option in Google Play, charities,

and many more commercial applications. PayPal has around 375 million active

accounts from all over the world and allows its users to exchange funds in 25

different currencies. Its app is available in the iTunes App Store and the Google

Play Store. Recently, PayPal also announced that it would invest in

cryptocurrency. The platform allows users to transfer funds between friends and

businesses. These payments are done quickly through the internet with no delay.

A fee is given to PayPal for each of these payments.

PayPal is a great option to make small payments and forsellers. The service is also useful for making payments in other countries when

using cash is not an option. It’s worth mentioning, though, that PayPal’s fee

may seem a bit scary, especially for bigger payments. The amount that is

subtracted from the receiver’s account depends on the amount of money

transferred. For this reason, some consider PayPal to be better suited for

small payments.

A new service, called Pay in 3 is also being offered to

UK residents. This new feature allows customers to make payments with three

interest-free lends. This comes with the expected credit score checks.

Is PayPal safe?

PayPal is a reputable digital wallet that is widely used

around the world. However, the platform has had criticisms and problems

regarding security. Since its beginnings

in the early 2000s, PayPal has always had problems with scammers and hackers.

Many fraudsters log into various accounts to make small payments to themselves

or other scammers.

Phishing is also a common problem for PayPal’s users. A

lot of cyber-criminals may send fake emails or messages requesting payments via

the platform. Fortunately, phishing attempts tend to be obvious, so a user just

has to be aware of who are they paying with PayPal.

PayPal’s website and app implement end-to-end encryption,

which means that it’s nearly impossible for hackers to steal information from

exchanges between two users. These are standards of modern web security.

However, this doesn’t stop fraudsters from stealing passwords by using social

engineering on their victims.

Because of this, the platform has developed proprietary

software to keep an eye on unauthorized activities. Sometimes, the activities

of a business may be interpreted by the algorithm as suspicious, resulting in

the retention of funds. In the worst cases, PayPal may even freeze a user’s

account without warning.

Most of the time these problems are minor inconveniences,

and funds tend to be quickly transferred. However, when it comes to companies

that rely on PayPal, this can cause a lot of damage. This is why PayPal

shouldn’t be used as a replacement for a bank service, but rather as a support

for an enterprise. PayPal is useful because it’s easy to set up in comparison

to other business solutions, but these disadvantages should always be kept in

mind.

As previously mentioned, PayPal is a legitimate service

and a great option for startups and small businesses. The digital wallet is

also great for individuals who want to set up quick payments. While the site’s

fees are worth considering, these are usually very competitive when it comes to

international transactions.

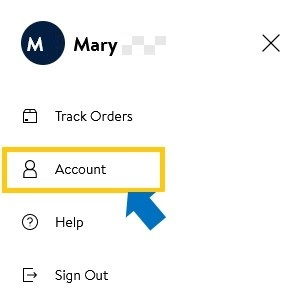

Another one of PayPal’s pros is that it is very easy to

get started with. To sign up, a user only needs a valid email. However, for the

best results, one has to verify their identity with a valid UK number

and their bank account to start adding funds. Its app and website are

user-friendly. PayPal has a great help section with articles to guide users and

a forum where any other questions can be asked.

PayPal also offers a business debit MasterCard, which

allows users to pay whenever MasterCard is accepted from and withdraw funds

from ATMs all over the world.

It’s worth considering all the pros and cons before

trying PayPal out. As a consumer, there are no major drawbacks to making

payments via PayPal. For sellers and businesses, PayPal is still a good option.

Go ahead and give it a try!

At the rates currently charged for international calls, it's possible that these costs will quickly add up. If you have a roaming M2M SIM Card, you can maintain the same phone number no matter where you travel, so you won't have to worry about updating people on your new address or getting their new contact information.

ReplyDeleteThanks for sharing wonderful blog keep do it and post more blogs.it is such a wonderful work.

ReplyDeleteaccidente de volquete

A Global eSIM Card, also known as a World eSIM Card or International eSIM Card, is a digital or electronic SIM card that provides data connectivity to users across multiple countries and regions around the world. As an eSIM, it offers the convenience of seamless data access without the need to physically change or swap SIM cards when traveling internationally.

ReplyDeleteThis is a great overview of what PayPal is and how it makes online transactions so convenient and secure. It’s amazing how it’s become such a trusted platform for sending and receiving money globally. Thanks for breaking it down so simply! virginia protective order violation

ReplyDeletewhat happens if you violate a protective order in virginia